Navigating Property Ownership in Summit County: A Guide to the Tax Map

Related Articles: Navigating Property Ownership in Summit County: A Guide to the Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Property Ownership in Summit County: A Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property Ownership in Summit County: A Guide to the Tax Map

Summit County, nestled in the heart of the Rocky Mountains, boasts breathtaking scenery and a vibrant community. Understanding the intricacies of property ownership within this region requires familiarity with the county’s comprehensive tax map. This vital tool serves as a cornerstone for property identification, valuation, and taxation, facilitating smooth transactions and ensuring equitable distribution of tax burdens.

Unveiling the Essence of the Tax Map

The Summit County Tax Map, a meticulously crafted digital and physical representation of the county’s land parcels, provides a detailed visual overview of property boundaries, ownership information, and associated tax data. This valuable resource serves as a cornerstone for various stakeholders, including:

- Property Owners: The tax map empowers property owners to accurately identify their land boundaries, understand their tax obligations, and access essential property information.

- Real Estate Professionals: Real estate agents and brokers rely on the tax map to conduct thorough property searches, verify ownership details, and assess property values.

- Government Officials: The tax map assists county officials in administering property taxes, managing land use, and facilitating development planning.

- Financial Institutions: Lenders and mortgage providers utilize the tax map to verify property ownership, assess collateral value, and ensure the security of their investments.

Decoding the Map’s Components

The Summit County Tax Map comprises several essential components that collectively offer a comprehensive view of property ownership:

- Parcel Identification Numbers (PINs): Each property within the county is assigned a unique PIN, serving as its digital fingerprint. This number acts as a key to accessing detailed information about the parcel, including its location, ownership, and tax status.

- Property Boundaries: The map accurately depicts the boundaries of each property, ensuring clarity in ownership and preventing disputes.

- Ownership Information: The tax map lists the current owner of each property, including their contact details and legal ownership status.

- Tax Assessment Data: The map displays the assessed value of each property, serving as the basis for calculating property taxes.

- Land Use Information: The tax map categorizes properties based on their designated land use, providing insights into zoning regulations and development potential.

Accessing the Summit County Tax Map

The Summit County Assessor’s Office provides various avenues for accessing the tax map:

- Online Portal: The Assessor’s website offers an interactive online map, allowing users to search for specific properties by address, PIN, or owner name.

- Public Records: The Assessor’s office maintains physical records of the tax map, available for public inspection during business hours.

- Property Appraisals: When seeking a property appraisal, the appraiser will utilize the tax map to determine the property’s boundaries, identify comparable properties, and assess its market value.

Benefits of Utilizing the Tax Map

The Summit County Tax Map offers a range of benefits to individuals and organizations alike:

- Transparency and Accountability: The tax map promotes transparency in property ownership and taxation, ensuring fairness and accountability within the county.

- Efficient Property Transactions: The map facilitates smooth and efficient property transactions by providing clear ownership information and accurate property descriptions.

- Informed Decision Making: By accessing comprehensive property data, individuals and businesses can make informed decisions regarding property purchases, investments, and development projects.

- Community Planning: The tax map serves as a valuable tool for community planning, enabling officials to analyze land use patterns, identify areas for development, and manage growth effectively.

Frequently Asked Questions (FAQs) about the Summit County Tax Map

Q: How can I find my property on the tax map?

A: You can access the Summit County Tax Map online through the Assessor’s website. Search by address, PIN, or owner name to locate your property.

Q: What if I see an error on the tax map?

A: Contact the Summit County Assessor’s Office to report any discrepancies or errors on the map. They will investigate and make necessary corrections.

Q: How can I obtain a copy of the tax map?

A: You can request a copy of the tax map from the Assessor’s Office, either in person or through their website.

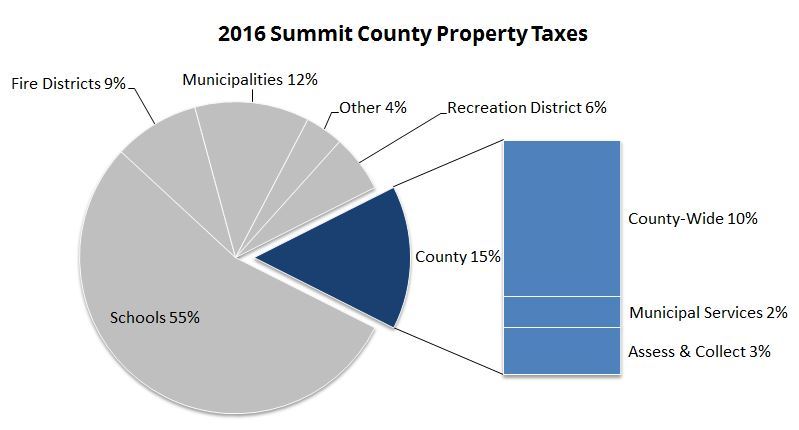

Q: How are property taxes calculated?

A: Property taxes are calculated based on the assessed value of the property and the county’s property tax rate. The assessed value is determined by the Assessor’s Office.

Q: What are the different land use categories on the tax map?

A: The tax map categorizes properties based on their designated land use, such as residential, commercial, agricultural, or industrial.

Tips for Using the Summit County Tax Map

- Familiarize Yourself with the Map: Take time to understand the map’s layout, symbols, and key features.

- Utilize the Search Functions: The online map offers various search options to locate specific properties efficiently.

- Verify Property Information: Always double-check the information on the map against official property records.

- Contact the Assessor’s Office: If you have any questions or require assistance, reach out to the Assessor’s Office for guidance.

Conclusion

The Summit County Tax Map stands as an invaluable resource for understanding and navigating property ownership within the county. Its comprehensive nature, accessibility, and vital role in property valuation and taxation make it an essential tool for property owners, real estate professionals, government officials, and financial institutions alike. By leveraging this resource, stakeholders can ensure informed decision-making, promote transparency, and contribute to the continued growth and prosperity of Summit County.

![Summit County Property Tax [2024] �� Guide to Summit County Ohio](https://summitmoving.com/wp-content/uploads/2023/04/Screenshot-2023-03-28-at-6.22.17-PM.png)

![Summit County Property Tax [2024] �� Guide to Summit County Ohio](https://summitmoving.com/wp-content/uploads/2023/04/Screenshot-2023-03-29-at-1.28.19-AM-996x1024.png)

![Summit County Property Tax [2024] �� Guide to Summit County Ohio](https://summitmoving.com/wp-content/uploads/2023/04/Screenshot-2023-04-26-at-2.47.20-PM-1024x414.png)

![Summit County Property Tax [2024] �� Guide to Summit County Ohio](https://summitmoving.com/wp-content/uploads/2023/04/Summit-County-Property-Taxes-1024x576.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating Property Ownership in Summit County: A Guide to the Tax Map. We hope you find this article informative and beneficial. See you in our next article!