Navigating Tennessee’s Real Estate Landscape: A Guide to Property Assessor Maps

Related Articles: Navigating Tennessee’s Real Estate Landscape: A Guide to Property Assessor Maps

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Tennessee’s Real Estate Landscape: A Guide to Property Assessor Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Tennessee’s Real Estate Landscape: A Guide to Property Assessor Maps

Tennessee’s property assessor maps, often referred to as "property tax maps," are invaluable tools for navigating the state’s real estate landscape. These maps, meticulously maintained by county assessor offices across the state, provide a comprehensive visual representation of property boundaries, ownership information, and property characteristics.

Understanding the Structure of Tennessee Property Assessor Maps

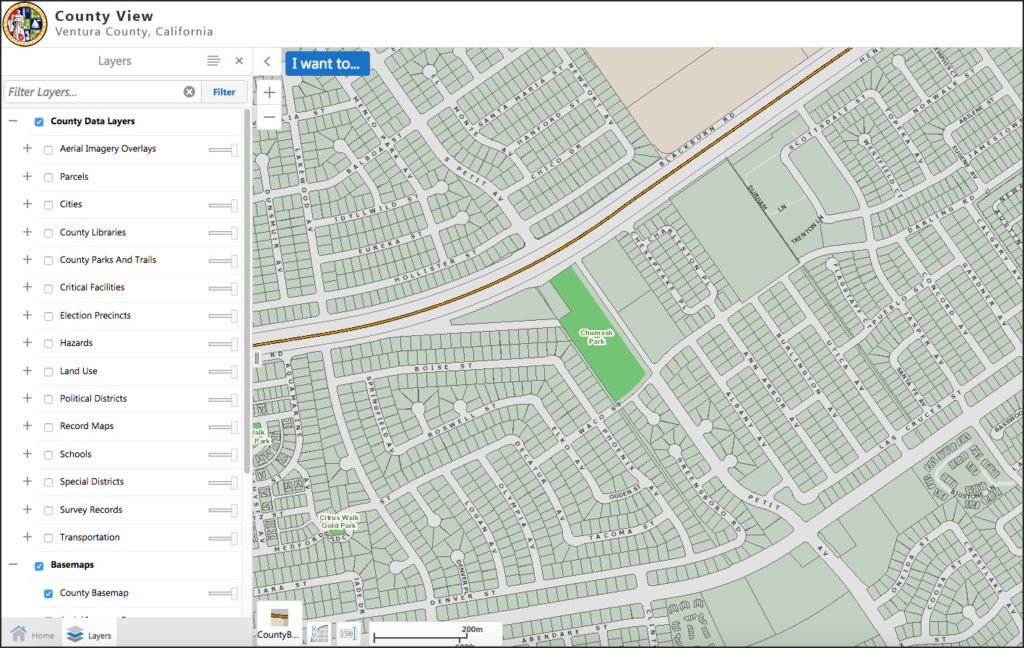

These maps are typically presented in digital format, accessible through online platforms, and often incorporate advanced features like interactive zooming, panning, and search functions. The core components of these maps are:

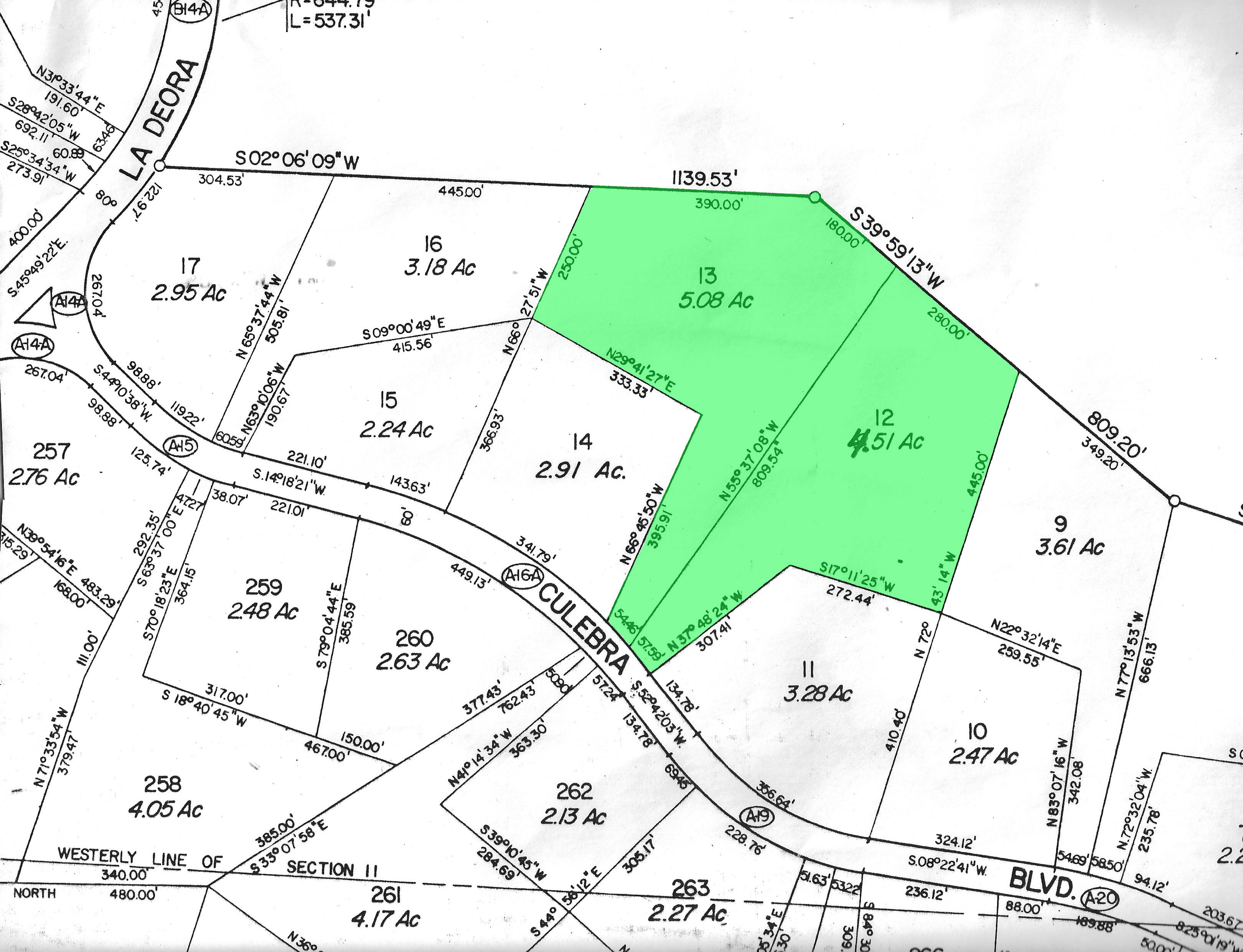

- Property Boundaries: Clear lines delineate the precise borders of each property, showcasing its size and shape.

- Property Identification Numbers (PINs): Each property is assigned a unique PIN, acting as its digital identifier. This number links to a database containing detailed property information.

- Ownership Information: The maps display the name of the current property owner, allowing for easy identification and research.

- Property Characteristics: Key features such as the property’s address, acreage, zoning classification, and even the presence of structures are often included.

- Tax Information: Information regarding the property’s assessed value, tax rates, and any outstanding property taxes may be displayed.

Benefits of Using Tennessee Property Assessor Maps

The accessibility and comprehensive nature of these maps offer numerous benefits for individuals and businesses alike:

- Property Research: Whether buying, selling, or simply researching real estate, these maps provide a visual overview of properties, facilitating informed decisions.

- Property Valuation: The maps offer insights into property values, allowing for comparisons within a specific area and assisting in negotiations.

- Investment Opportunities: Investors can identify potential properties based on location, size, and zoning, aiding in strategic investment choices.

- Land Development: Developers can use the maps to assess the suitability of land for specific projects, considering factors like zoning and accessibility.

- Boundary Disputes: In cases of property boundary disputes, these maps provide a clear visual representation of the boundaries, aiding in conflict resolution.

- Tax Appeals: Property owners can use the map information to support their tax appeals, demonstrating potential discrepancies in assessed values.

- Property Management: Landlords and property managers can utilize the maps to track properties, manage tenants, and optimize maintenance efforts.

- Community Planning: Local governments and planning authorities rely on these maps to understand land use patterns, guide development, and implement zoning regulations.

Accessing Tennessee Property Assessor Maps

Access to these valuable resources is readily available through various channels:

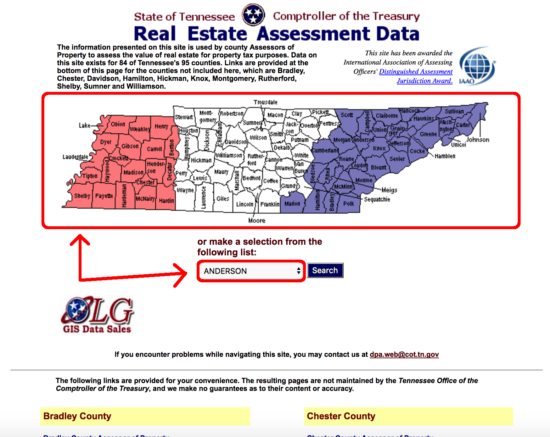

- County Assessor Websites: Each county in Tennessee has its own website, often featuring an interactive map interface.

- State Government Websites: The Tennessee Department of Revenue and the Tennessee Association of Assessing Officers provide links to county assessor websites.

- Third-Party Real Estate Platforms: Popular real estate websites often integrate data from property assessor maps, offering convenient access.

Frequently Asked Questions about Tennessee Property Assessor Maps

Q: Are Tennessee property assessor maps available for all counties?

A: Yes, each county in Tennessee has its own assessor’s office responsible for maintaining and updating property maps.

Q: How accurate are the maps?

A: While the maps strive for accuracy, it’s important to note that they may not always reflect the most up-to-date information. It’s advisable to verify information with the county assessor’s office.

Q: Can I access the maps for free?

A: Access to the maps is generally free, although some websites might offer premium features with additional fees.

Q: Can I download the maps for offline use?

A: Some websites allow downloads, while others might require specific software or subscription services.

Q: What if I find an error on the map?

A: Contact the county assessor’s office directly to report any inaccuracies or discrepancies.

Tips for Using Tennessee Property Assessor Maps Effectively

- Familiarize Yourself with the Map Interface: Explore the map’s features and functionalities to maximize its potential.

- Utilize Search Functions: Use the search bar to locate specific properties by address, PIN, or owner name.

- Zoom and Pan: Zoom in for detailed views and pan across the map to explore wider areas.

- Layer Information: Many maps allow you to overlay different data layers, such as zoning, flood zones, or utilities.

- Compare Properties: Use the map to compare property values, sizes, and features within a specific neighborhood.

- Verify Information: While the maps are generally accurate, it’s always prudent to verify information with the county assessor’s office.

Conclusion

Tennessee property assessor maps are indispensable resources for anyone involved in real estate transactions, land development, or property management. By providing a comprehensive and visually engaging representation of property information, these maps empower individuals and businesses to make informed decisions, navigate the complexities of Tennessee’s real estate market, and ultimately achieve their property-related goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating Tennessee’s Real Estate Landscape: A Guide to Property Assessor Maps. We hope you find this article informative and beneficial. See you in our next article!